|

|

RSS Feed  |

a playground of art, photos, videos, writing, music, life |

|

|

You are here

|

Creativity!

|

Get it!

|

I like it!

|

Fun stuff!

|

About me...

|

| |

|

|

|

|

Random Quote

Even if my marriage is falling apart and my children are unhappy, there is still a part of me that says, 'God! This is fascinating!'

-- Jane Smiley

|

|

|

|

|

|

Page Through Blog: << More Recent Posts | Home Page | Earlier Posts >>

Blog Archive by Month | Blog Archive by Story or Tag | Search Blog and Comments

For the first time in a long time, I will be without client starting Wednesday. That's not to say that I'll be idle. I've been helping a local non-profit re-brand, partnering with two other companies to re-introduce 247Toolset (which is going well), and I'll be catching up on some study that I'd wanted to do on productivity. Also, there's a mortgage industry idea that I'd had a while back that's getting some traction, and hopefully within the next few weeks, I'll be able to talk more about that. On Thursday, we attended my grandfather's funeral, and I wanted to say a hearty "Thank you!" to those who extended their warm thoughts my way here on the site and in person. It helped. One of the good things that has come of this tragedy is that my grandmother, Nana, whom I adore, was able to come to our house yesterday with my parents and family friend, BJ, and we all had lunch and played games through the afternoon. It was such a good time :) As they were leaving, Tamara noticed the smudges from our dogs on the entry way window and took some Windex to it. Nana stepped through the door, then turned around to mischievously jab her fingers into the clean glass, winking at a surprised and laughing Tamara who was on the other side of the glass, and then made her getaway to the waiting van. My mom noticed the whole episode, and mouthed to me that she hadn't seen Nana so full of life in quite some time. Family helps to restore in a time of loss, and to see Nana be playful and young was nourishing to us all. There are plans that she will move from Illinois to live with my folks in Ames, a short drive from here. I think yesterday worked some fixative into those plans. Tamara and I would love to spend more time with the firebrand that is my 81-year-old grandmother. |

|

|

Governing (aka, Controlling) |

Government money is all fun and games until the government starts telling you how to live your life. Don't take the dime if you want say in how you spend your time... Personally, I think this idea of capping retreats and capping executive pay is brilliant. Short-sighted companies will take the government's bailout money and give up their freedom and allow the politicians and bureaucrats to start calling the shots. Smart companies will tell the government to keep its money and butt out and enjoy control over how they run their own company and reward their own people. Principle at work: Choose freedom and believe in yourself enough to figure it out. |

|

|

A guy where I consult referred me to the web site of a person who traveled to Chernobyl on motorcycle and took pictures. Ghost Town is a modern Pompeii. The Soviet era is preserved here - in the radiation, for 18 years. It's a pretty interesting tour.In light of North Korea's and Iran's latest accomplishments, I'd say it's important to remember the damage that nuclear materials can cause. |

|

|

A few months ago, I partitioned my web site into private and public content. It was a tough decision for me, but never being fearful of falling full on my face, I decided to do so. I'm done with that. I'm also gonna go back to making political cartoons as I was during the election. There's simply too much fodder in Washington to ignore the opportunity of ridiculing our ridiculous political class. The government sucks and deserves to be skewered. A lot. And often. Sometime in the next two days, I'll unpartition the web site. In celebration of my decision, here's a repost of one of my toons, which seems appropriate to the pork-loaded stimulus bill guaranteed to bankrupt your children and grandchildren:  |

|

|

Earlier today I got a phone call from my mother telling me that my grandfather had a heart attack. About 90 minutes later, I learned he died. He recently fell in his ice-covered driveway and broke every rib on one side. One of those broken bones pierced and collapsed his lung. He'd been struggling to recover from that, but his blood pressure never made it to normal levels, hovering around 70/30. We talked several times a week while he worked to get better. We were pretty close. Rogers is not my birth name, but rather the name of the second man that my mom married, a man who was a raging alcoholic. I never knew my bio dad until years later. The examples of men up to that point in my life were pretty much disappointments. My grandmother, Nana, married Jerry after my mom married Rogers. Nana and Jerry lived in Rockford, Illinois, far from Sioux City, Iowa, where we lived. We saw them a couple of times a year. Each time I saw Jerry, I saw that he treated Nana with great care and respect, unlike how Rogers treated my mother. Jerry was a strong union man, and not shy about his opinions. He always told me that if I had the courage to speak an opinion, I should have the backbone to sign my name to it - in big letters. He loved America - to the point where he wouldn't buy anything that wasn't American-made. To me, he came to define what a man was, something my step-father, Rogers, never approached. When my step-father beat my mom and put her in the hospital, it was Jerry who drove from Rockford and beat the living crap out of the man who hurt my mother. It was the last time Rogers touched her. I'd like to think that it was Jerry's influence that helped Mom finally choose a good man in marrying her third husband, Kerm, who to this day treats my mom with the same great care and respect that Jerry always treated Nana. Though Jerry came into Mom's life when she was well into adulthood, he loved her completely as his daughter. They had a remarkable relationship. It was this giant of a man who taught me how to be an American, how to love a woman, how to play cribbage, and how to have manners at the dinner table. He was the closest thing to a dad I've known. And I'd like to think that God gave me influence over 6 young men - sons and step-sons - to help carry on what Jerry taught me. Jerry's greatest gift to me was his unwavering belief in me. He loved my art, raved about my cards, and was always immensely proud of my achievements as though they were his own. I'm lucky to have known such a truly great man. |

|

|

How many people can you name who are exceptional at picking stock market winners with consistency? Wall Street has a winner every now and then who guessed and timed the market just right and hit it big with their prediction. But after that, most of the time their market predictions tend to falter. In short, no one is great all of the time. A few, like Warren Buffet, do well over time, but Mr. Buffet never picks startup companies. He picks companies that show a solid track record over time. And even in the current financial climate, his numbers drop and his selections falter. Not all money is equal. I can spend money on Starbucks coffee every day, or I can use that money to pay down my car loan, or I can use it to pay for an online class. In the first example, I just spend it. The money is gone and I have nothing to show for it. My money is worth only its face value.

In the second example, I pay down the principal on my loan, and so I actually shave money from the interest I would otherwise pay - which in effect makes my money more valuable. My money is now worth its face value plus the interest I don't have to pay.

In the third example, I invest in myself. If the class makes me more marketable, then my money might mean continued employment or a higher salary. My money is again worth more than its face value. When an investor puts money into a company, they want a return on investment. To achieve that, they need to know that the product is wanted in the market, that the company is able to sustain production equal to demand, and that the costs have been wrung out of the production to maximize profit. The question for the investor is: which company represents the best ongoing value? Because all money invested is not equal. Would an investor put money into an enterprise that consistently loses money? Of course not.

Would an investor put money into an enterprise that will only use the money to pay down its debts? Not likely, because debt reduction alone doesn't generate more revenue.

Would an investor put money into an enterprise that will use the money to improve the product or the marketing or the customer relations? The bailout / stimulus money is being given to enterprises that would potentially fail without the money. Why is this a good investment? And why should we believe that anyone within the government will choose the right companies for an investment that will stimulate the economy? The tax dollars of you and your children are being redirected toward companies seemingly incapable of sustaining a profit to continue to exist. Is the company's product wanted in the market? Is the company able to sustain production equal to demand? Have the costs been wrung out to maximize profit? Few people are asking these questions, and the government isn't too keen on the details of where all of this money is going. Doesn't this beg for accountability? |

|

|

I went on Amazon and bought my son four very nice dress shirts - for $10.50 each. Grand total: $42.00, and free shipping through Amazon Prime. If you know a man who needs quality shirts, it's a very good deal. |

|

|

Drawn on my Verizon LG Dare Drawing Pad:  (You can sign up to have a new drawing sent to you daily by picture message.) |

|

|

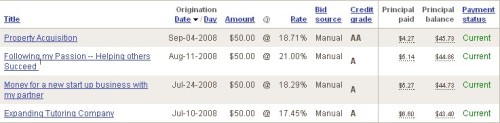

Last summer, Tamara and I used Prosper, an online P2P lender, and lent money to four strangers. As you can see by the snapshot of our loans, they're performing well. No problems. All current. Last month, I withdrew some of the money I'd earned back. Last fall, the SEC decided that these P2P lenders weren't regulated enough and issued cease-and-desist letters. After watching all of the shenanigans by the "professionals" and the "official" institutions, the ineffectual SEC had heartache about this? Personally, I think the government was trying to prevent us in the cheap seats from cutting out the expensive middle man (the bank) at a time when the banks needed bailing out saw an opportunity for cheap money - ours, via the government. Only one P2P lender made the cut: lendingclub.com, which has a 1% servicing fee for lenders. What sucks about it though is that it seems I can't define my own interest rate when negotiating a loan with a borrower - which was all of the fun of it. Plus, my return would be far less with lendingclub than what I made/make with Prosper.com. Which gets back to what I said a bit ago - the government sticking its nose into it and making it more like an actual bank. Which begs - why do this if it's just another bank? I like this guy's take. See comment 5 for more of his opinion. |

|

|

|

|

|

|

|