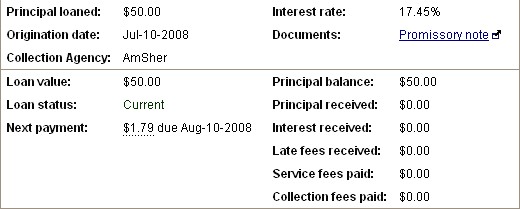

I'm a banker, and here's my first loan that I've made, to a person wanting to expand their business and who has A-grade credit.  I'm not the only one who invested in this person. 246 other people did as well, at various amounts. All together, we loaned this person $10,000. After 36 months of $1.79 payments made to me, my $50.00 investment into someone's dream will become $64.44. That's $14.44 in three years' time. That's a decent conservative return and it sure beats any CD or savings account at a bank. I plan to tell my folks about this. They're gonna retire soon, and I bet that they would love to invest in this. They'd think it was fun. I wonder what will happen when 79 million baby boomers start to learn about this... A growing segment of student loans, car loans, home improvement, small business, and debt consolidation loans are happening like this. Disruptive innovation happens on the fringes. Then it becomes mainstream. Then companies scramble to find a way to stay relevant. It'll be interesting to see how P2P lending plays out. |