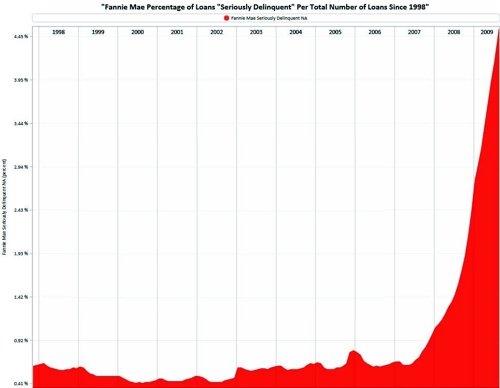

The latest Fannie Mae delinquency chart:  Each column is a year, and that last column is 2009. Notice how stable it was for years. Mid-2007, it started to move upward in a serious way as all of those homes went under water for the super-risky products being offered. When I worked at Wells Fargo, I asked the verbotten question: "What happens if Fannie goes out of business?" I was laughed at. (Still laughing, Joe?) The problem with Fannie (and Freddie): there are no free-market alternatives. That's what happens when you kill the free-market. There is no mechanism for corrective action. And this failed government enterprise posing as a "business" just keeps expanding its book of business. So back when I worked as a strategy consultant to Wells Fargo, I urged them to begin to develop a private alternative to Fannie. I told them that they were no different than a one-crop farmer. No one took this seriously. Farmer, meet the corn worm. There are two ways out of this for banks: - Develop and invest in a free-market alternative.

- Let your kids pay all of this debt off when the government - i.e. taxpayers - just soaks all of this up.

I consider that latter to be hugely immoral, but I know that doesn't seem to bother some folks. |