|

|

RSS Feed  |

a playground of art, photos, videos, writing, music, life |

|

|

You are here

|

Creativity!

|

Get it!

|

I like it!

|

Fun stuff!

|

About me...

|

| |

|

|

|

|

Random Quote

If the writing is honest it cannot be separated from the man who wrote it.

-- Unknown

|

|

|

|

|

|

|

|

|

|

Blog - Blog Archive by Month - Blog Archive by Tag - Search Blog and Comments

|

<-- Go to Previous Page

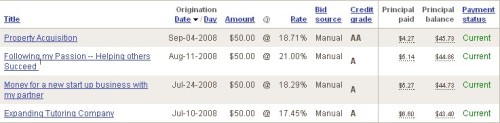

Last summer, Tamara and I used Prosper, an online P2P lender, and lent money to four strangers. As you can see by the snapshot of our loans, they're performing well. No problems. All current. Last month, I withdrew some of the money I'd earned back. Last fall, the SEC decided that these P2P lenders weren't regulated enough and issued cease-and-desist letters. After watching all of the shenanigans by the "professionals" and the "official" institutions, the ineffectual SEC had heartache about this? Personally, I think the government was trying to prevent us in the cheap seats from cutting out the expensive middle man (the bank) at a time when the banks needed bailing out saw an opportunity for cheap money - ours, via the government. Only one P2P lender made the cut: lendingclub.com, which has a 1% servicing fee for lenders. What sucks about it though is that it seems I can't define my own interest rate when negotiating a loan with a borrower - which was all of the fun of it. Plus, my return would be far less with lendingclub than what I made/make with Prosper.com. Which gets back to what I said a bit ago - the government sticking its nose into it and making it more like an actual bank. Which begs - why do this if it's just another bank? I like this guy's take. See comment 5 for more of his opinion. |

by Brett Rogers, 1/16/2009 12:42:15 AM

Permalink

|

|

|

|

| Comments

|

It sucks that the SEC suddenly turned their heads on P2P lending and decided to mess it up. I've been lending on both Prosper and Lending Club for 1+ yrs and so far, they are both doing well, although the LC on is sligthly better (lower defaults). Even though you can't set the price with LC, at least they tell you how they set it, so you can decide if the price is right based on risk. |

| | Posted by Mercedes, 1/17/2009 8:33:04 PM |

|

|

Our quiet period lasted nearly 6 months, the SEC definitely did not make the process an easy one. Now that we have completed it, we are the only SEC registered P2P platform, which is pretty cool. One note about interest rates. Prosper's model allowed lenders to bid down rates, often to lower levels than they should be for the borrowers credit risk. Lending Club only accepts 660+ FICO score borrowers and we recently raised our interest rates across the board. We are still much more competitive than your normal bank private loan or credit card, but we want to make sure our Lenders have a good experience on the platform. And thus we set the interest rates accordingly. @Mercedes - After 1 year in operation Prosper had around 10% in defaults. After our first year, 2.7%. Big difference. |

|

|

Thanks DK and Mercedes for chiming in. I strongly believe in the P2P platform, so I'm glad that someone's in it, but I liked quite a bit an ability to negotiate part of the deal with the borrower. It feels like LC is trying to dummy proof the lending for the lender by fixing rates. Different way of doing it - it just isn't something I'll be inclined to do. Here's what I want to know: when does the P2P platform do home loans? Because at that point, the whole mortgage industry undergoes a most remarkable transformation. |

|

|

I believe in the p-2-p model so much so, I started www.zimplemoney.com an alternative to the public auction sites. Check us out. |

|

|

Add Your Comment:

|

|

|

|

|

|